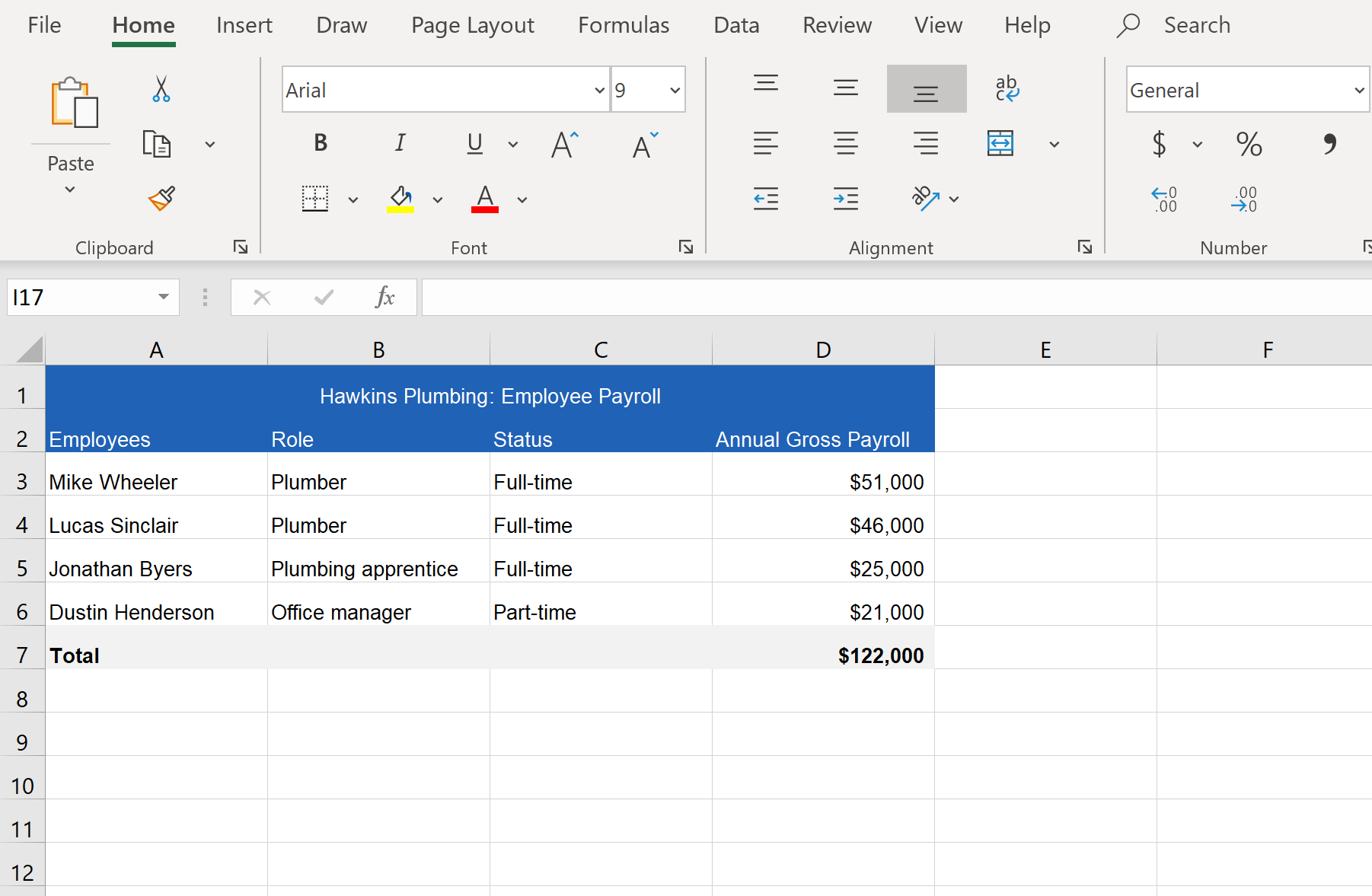

workers comp taxes for employers

Social Security has a wage base limit which for 2022 is. Tinton Falls Office 788 Shrewsbury Ave Suite 2209.

Payroll Journal Entries Financial Statements Balance Sheets Video Lesson Transcript Study Com

Employers Quarterly Federal Tax Return Form W-2.

/workerscompensation-82c488f6cf5d4431a994ecfdc8373f4f.jpg)

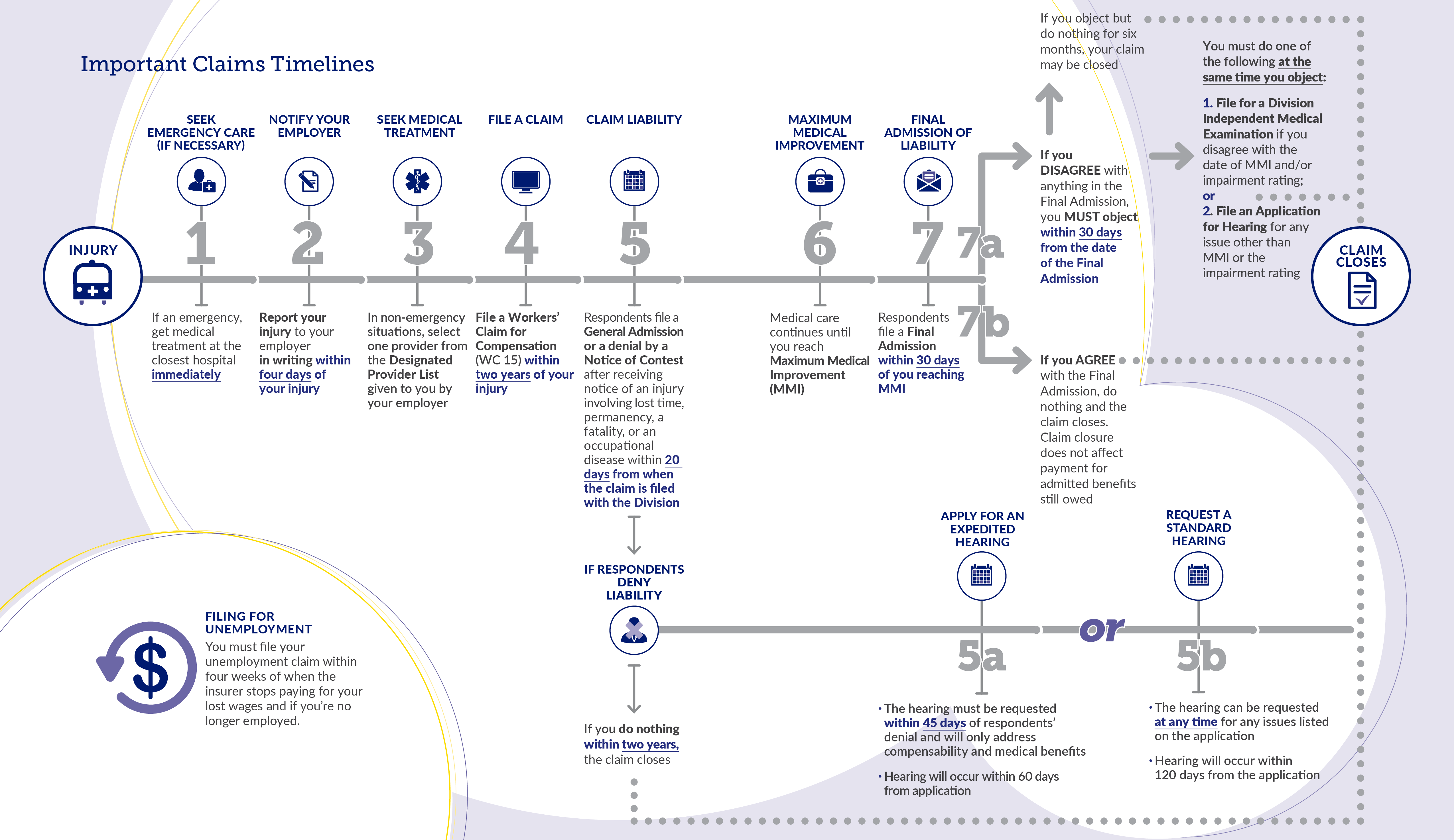

. SUTA claims review and quarterly reports. Workers Compensation also mitigates risk for employers employees who accept workers comp benefits cant sue the employer for damages unless the injury intentionally caused by the. No need to worry about employer tax prep and filing as all included.

The Social Security tax rate is 62 percent of an employees income or earnings up to a maximum wage of 132900 for the 2019. Workers compensation code 8810 refers to administrative and clerical work. While workers compensation payments are considered income theyre not subject to an income tax and you dont need to report them on your IRS forms.

There is no wage base limit for Medicare. This exempt status applies to any money you receive as. 124 to cover Social Security and 29 to cover Medicare.

The Unemployment Tax Services system allows employers with 1000 or fewer employees to file wage reports via the Internet. Visit the web for other workers compensation informational material including the PA WC Annual Report the most frequently asked workers compensation questions and safety committee. The fee for the employer is 230 times the number of covered employees working on the last day of the quarter.

When your employees are receiving workers compensation benefits they may wonder if theyll have to pay taxes on them. Workers Compensation Code 8810. FICA FUTA SUTA tax payments and filings.

Workers Comp and 1099 Contractors. Any workers compensation you receive as part of a work-related injury or sickness is normally fully exempt from taxation. Gain better control of your cash flow and expenses.

This code is the same throughout the United States including the. School employers can choose to participate in the School Employees Fund which is a special reimbursable financing method. This free service provides four options for.

The supervisor must contact the employees. Clifton Office 1135 Clifton Avenue Suite 11 Clifton NJ 07013. Start your workmans compensation insurance quote online or give us a call today at 888-611-7467.

Wages are compensation for an employees personal. IRS Publication 525 pg. The Medicare tax rate is 145 each for the employee and employer unchanged from 2021.

The social security wage base limit is 147000. The employer must obtain a workers compensation insurance policy. Wages and salaries including retroactive pay compensation added to a paycheck if an employee was underpaid for some reason Overtime or double time pay at the employees base rate.

Our workers compensation services provide efficiencies by having premiums based on your actual. We want to be your workers compensation agency. For employers the two FICA tax rates are.

Employers engaged in a trade or business who pay compensation Form 9465. This 153 federal tax is made up of two parts. The quick answer is that generally workers compensation benefits.

Workers Compensation in Newark NJ.

Unemployment Tax Rate 2021 Alabama Retail Association

What Is Workers Compensation Article

How Do Taxes Factor Into Workers Compensation

Is Workers Compensation Taxable The Turbotax Blog

Workers Compensation Insurance Requirements By State Nerdwallet

Workers Compensation Payroll Calculation How To Get It Right

Workers Compensation Settlement Phalenlawfirm Com Ks Or Molaw Office Of Will Phalen

Workers Compensation Department Of Labor Employment

What Wages Are Subject To Workers Comp Hourly Inc

Ohio Workers Compensation Benefits And Income Tax Monast Law Office

Florida Workers Compensation Insurance Laws Forbes Advisor

How To Delegate Payroll Employee Related Tax Filings And Associated Employer Duties To A Professional Employer Organization The Cpa Journal

Is Workers Compensation Taxable The Turbotax Blog

Do I Have To Pay Taxes On A Workers Compensation Settlement Workers Compensation Lawyers Ben Crump

Publication 957 01 2013 Reporting Back Pay And Special Wage Payments To The Social Security Administration Internal Revenue Service

Payroll Taxes Costs And Benefits Paid By Employers Accountingcoach

Issues With Multi State Payroll Tax Withholding An Employer S Guide